As talent acquisition (TA) leaders, one of the frustrations we face is justifying why we need resources to perform our jobs to the best of our ability. There’s a constant focus on “faster and cheaper;” yet we know that doesn’t help us attract the right people.

Over the last decade talent acquisition has gone through a transformation. The function is increasingly being seen as a strategic business partner; one tasked with finding a solution to organizational talent needs and challenges. Though TA has come a long way, certain aspects of it have not—like the metrics time-to-hire, cost-per-hire, and quality-of-hire. There’s still room for improvement here.

Table of Contents

- The problem with legacy recruiting metrics

- The three metrics of Hiring Success

- Hiring Budget

- Hiring Velocity

- Net Hiring Score

- Hiring Scorecard

The problem with legacy recruiting metrics

These metrics are not connected to business outcomes. Time-to-hire and cost-per-hire can provide solutions that are faster and cheaper, but these two attributes won’t actually help create long-term hiring solutions for organizations.

If you report to your CHRO that your average cost -per-hire is X-amount of dollars and your average time-to-fill is X-number of days, the most likely response you’ll receive is, “Can you lower the cost or reduce the time?”

Using legacy recruiting metrics, you won’t be able to have a conversation about how to quantify the return on investment of upgrading your recruitment tech stack, revamping hiring processes, or re-thinking recruiting strategies.

Also, these metrics don’t account for the nuances of hiring for different roles. Hiring a CTO will likely cost much more and take a longer time than hiring a office manager, but using average cost-per-hire or time-to-fill does not account for that.

The challenge with quality-of-hire is that the definition of “quality” is not standardized. How exactly do you measure it? Do you have to wait for year-end performance reviews or employee turnover? Do you measure employee satisfaction or performance?

What’s the solution?

We need a set of metrics that will allow us to clearly demonstrate our ability to deliver the right quality of talent, on time (to ensure our companies’ business objectives are met), and against the right budget. We need the metrics of Hiring Success.

The three metrics of Hiring Success

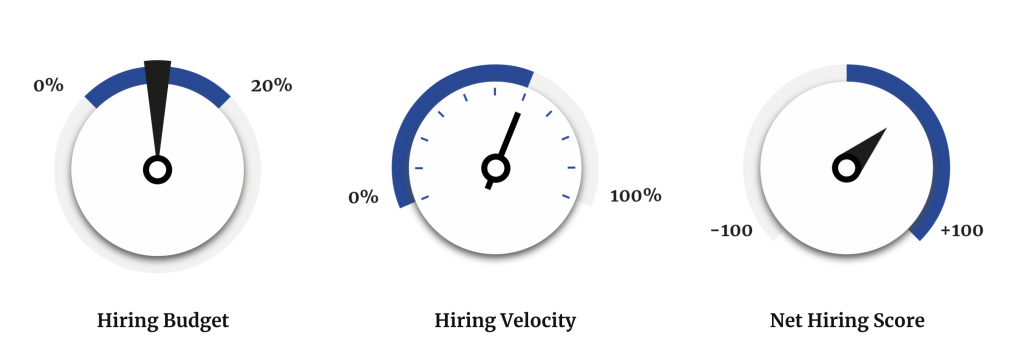

Hiring Budget

Hiring Budget reframes the costs of recruiting as an investment by anchoring the recruiting budget relative to the salary of people hired. The end result is a percentage, which is calculated by taking the total cost of recruiting and dividing it by the combined total salaries of new employees or New Hire Payroll (NHP).

An organization’s recruiting costs includes the salary of all talent acquisition team members, program spend, outside recruiters, travel costs of candidates, and technology infrastructure. Time spent by hiring teams engaging in the process is excluded.

Hiring budget reframes your recruiting costs akin to customer acquisition costs used in sales & marketing – the amount you invest in hiring a candidate should be tied to the value of that employee (i.e, higher value employees typically command higher salaries). With this new frame, you can now tailor your recruiting investment based on the type of role you are trying to hire. For example, you can justify higher recruiting costs for hiring high-value employees such as a new CTO.

Hiring Velocity

Hiring Velocity measures one thing: the percentage of jobs filled on time. Why is this important? Well, it answers one simple question: Are we able to hire the people we need when we need them? It’s critical for CEOs and their executive teams to know that their decisions and plans can be implemented because they have a TA organization that can deliver results. For example:

- Are sales people hired “on time” to hit next year’s growth targets?

- Are software developers hired “on time” to build a new product?

- Are enough drivers being hired “on time” to manage expected delivery demand during the holiday season?

For these scenarios, it doesn’t necessarily matter how long it takes to hire; what matters is whether or not the talent needed to achieve company wide goals are hired according to schedule. This metric also forces TA teams & executives to think more strategically about their hiring goals. You can now set realistic target start dates based on the type of role you’re hiring.

Net Hiring Score

How do you develop a reliable metric to measure how well new hires fit with the organization? We looked at the Net Promoter Score: a simple, solid, and straightforward method that evaluates consumer sentiment. With a similar mindset, we created the Net Hiring Score (NHS), which evaluates the fit of each hire based on the following:

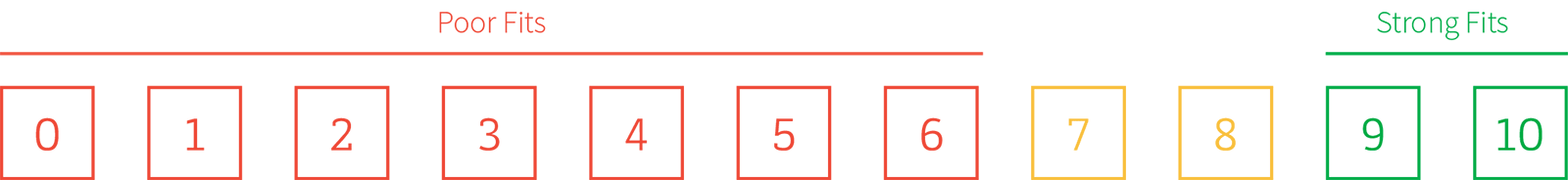

- 90 days in, we ask hiring managers one question: On a scale of 0 to 10, is this person the right fit for the job? This gives us a sense of employee performance.

- 90 days in, we ask new hires one question: On a scale of 0 to 10, is this job the right fit for you? This gives us a sense of employee satisfaction.

- We then take the average of those scores for each individuals. New hires who average 9-10 are considered Strong Fits and those who average 0-6 are classified as Poor Fits

- Aggregating the scores across all new hires and subtracting the percentage of detractors from the percentage of advocates gives the Net Hiring Scores

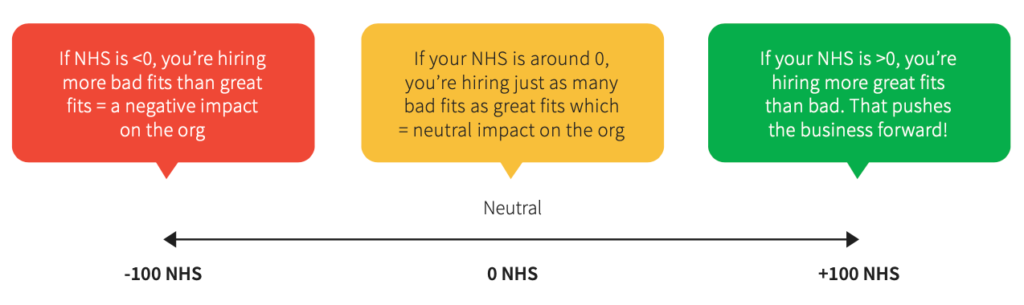

A score of zero, for example, indicates a company is hiring as many bad fits as good ones, resulting in a net neutral impact on the company. Above zero, a company is hiring more good hires than bad ones. Below zero, and the company’s bad fits outweigh the good ones.

The value of using the NHS is two-fold. First, you now have an objective, scalable method to quickly assess the performance of your recruiting team & process without having to wait for year-end review or turnover. Second, you can accurately measure both employee satisfaction & employee performance.

Hiring Scorecard

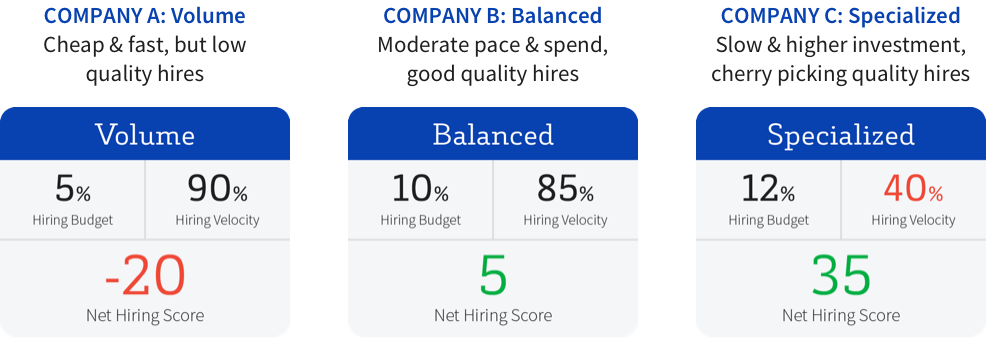

Once these metrics are determined, they’re put together in the form of a Hiring Scorecard. This will allow you and your colleagues to finally have a conversation about what matters: Are you delivering on budget, on time, and are you hiring the right people?

Below you’ll find three scorecards for existing organizations that were assessed using the Hiring Success metrics. On the left is an American retailer that has a strong focus on delivering on time. This approach to hiring tends to result in subpar hires, as is reflected in the NHS (Net Hiring Score). On the right is a prominent gaming studio; they strongly focus on hiring the best of the best. This affects their ability to source talent on time, as is evidenced by their Hiring Velocity score. This could potentially pose a problem if the company needs to scale up in a short period.

With this scorecard, hiring teams can now have more compelling conversations about Hiring Budget and its relationship to business outcomes. For example, if there’s a proposed decrease in spending, talent teams can point to the potential harm it could have on their ability to source—on schedule—the talent the company needs to succeed.

On the other hand, the Hiring Success metrics also make it easier to build a business case for investing in new technology or other resources. For example, when describing the return on investment of a CRM, it can be linked to the expected impact on Hiring Velocity and Net Hiring Score. Additionally, the Hiring Success Scorecard makes benchmarking possible by comparing performance against industry averages.

Closing thoughts

It’s essential for TA teams to measure and track the work they do, and their outcomes. However, it’s equally essential to have a clear idea of what you’re measuring and why. The Hiring Success metrics provide others with a much clearer picture of the work you do, thus improving your chances of being a successful and strategic business partner.

Enroll in the Master Class & earn 6 SHRM credits

Enroll in the Master Class & earn 6 SHRM credits